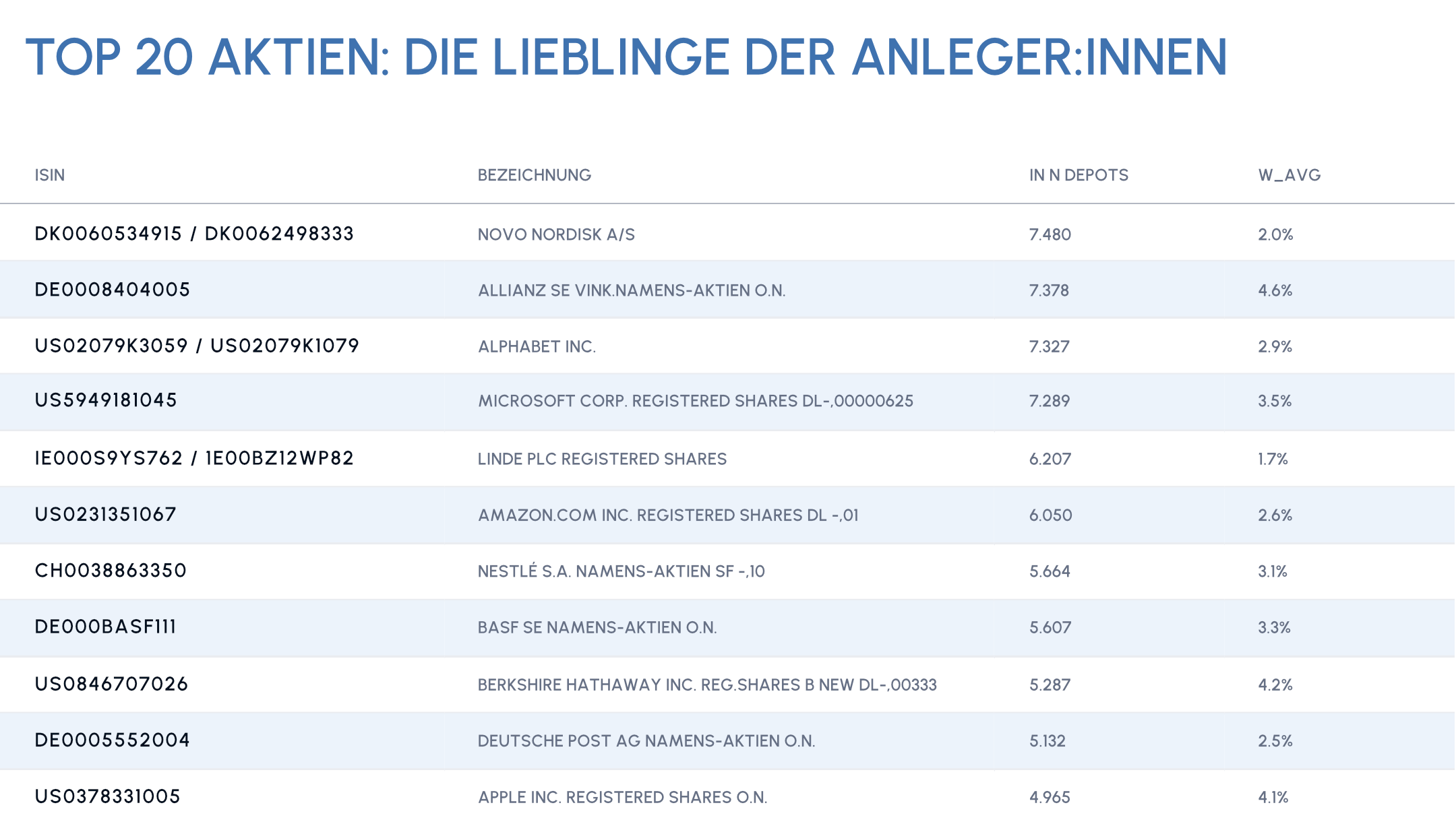

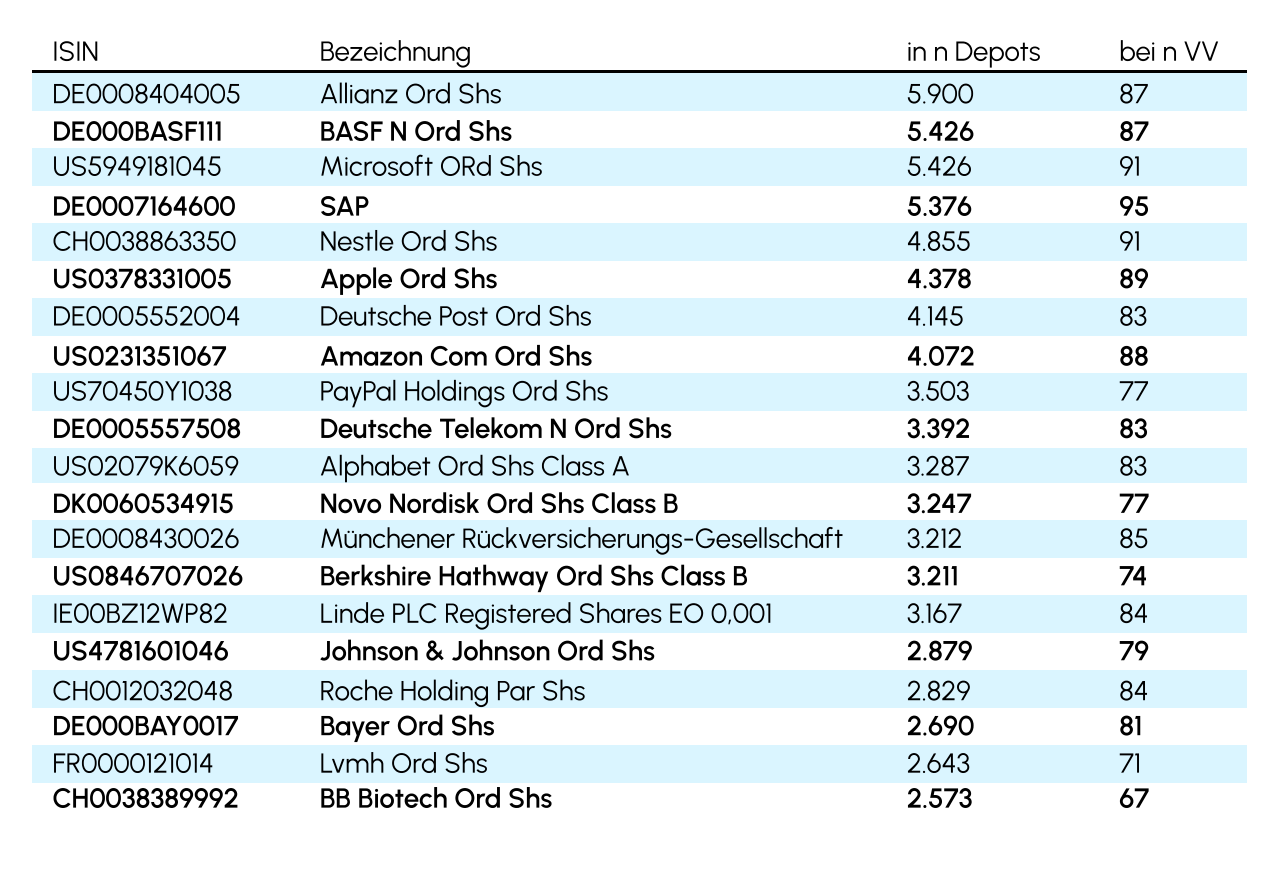

How do Germans invest? The Institut für Vermögensaufbau (IVA) and wealth management software provider QPLIX have investigated this question and presented the German-language study "Trendmonitor Vermögensverwaltung (TMVV)".

With more than 54,000 real client portfolios analysed, the TMVV is the largest and most in-depth analysis of its kind in the German-speaking world. The TMVV is a spin-off of the CAPITAL studies Top Asset Managers 2019 to 2023, in which over 100 independent asset managers took part. The anonymous and aggregated portfolio holdings data was provided for the studies by the custodian banks V-BANK, DAB BNP Paribas, Deutsche Bank, Baaderbank and Donner & Reuschel on the basis of authorisation by the participating asset managers. IVA and QPLIX have now analysed this anonymous data from an asset allocation perspective and published it for the first time in the Trend Monitor.