How QPLIX Supports Wealth Managers in Optimizing Investment Strategies

With digitalised order management, wealth managers can optimise their processes, increase efficiency and client satisfaction, and open up new growth opportunities. Staying ahead of the competition, optimising investment strategies, and effectively managing client portfolios require a combination of expertise, time, and efficient tools. In this blog post, we will delve into the key concepts and benefits of trading automation, empowering you to streamline your operations, enhance decision-making, and unlock new avenues for growth.

In portfolio management, there are complex tasks such as the asset allocation or rebalancing strategy. Human expertise is indispensable here. In contrast, the purely operational part, i.e. the calculation and execution of orders within the framework of the investment guidelines, is a repetitive act and offers great potential for automation. This is especially true for rebalancing - trading activities triggered by planned portfolio shifts within their respective strategies. While these usually account for the lion's share of orders, the life cycle of a portfolio requires even more. Trading activities start with the opening of new client portfolios. Existing clients request withdrawals, add new capital or decide to change strategy. For many of these events, asset managers are legally obliged to process the resulting orders promptly. Otherwise, there is a risk of claims for damages and reputational damage.

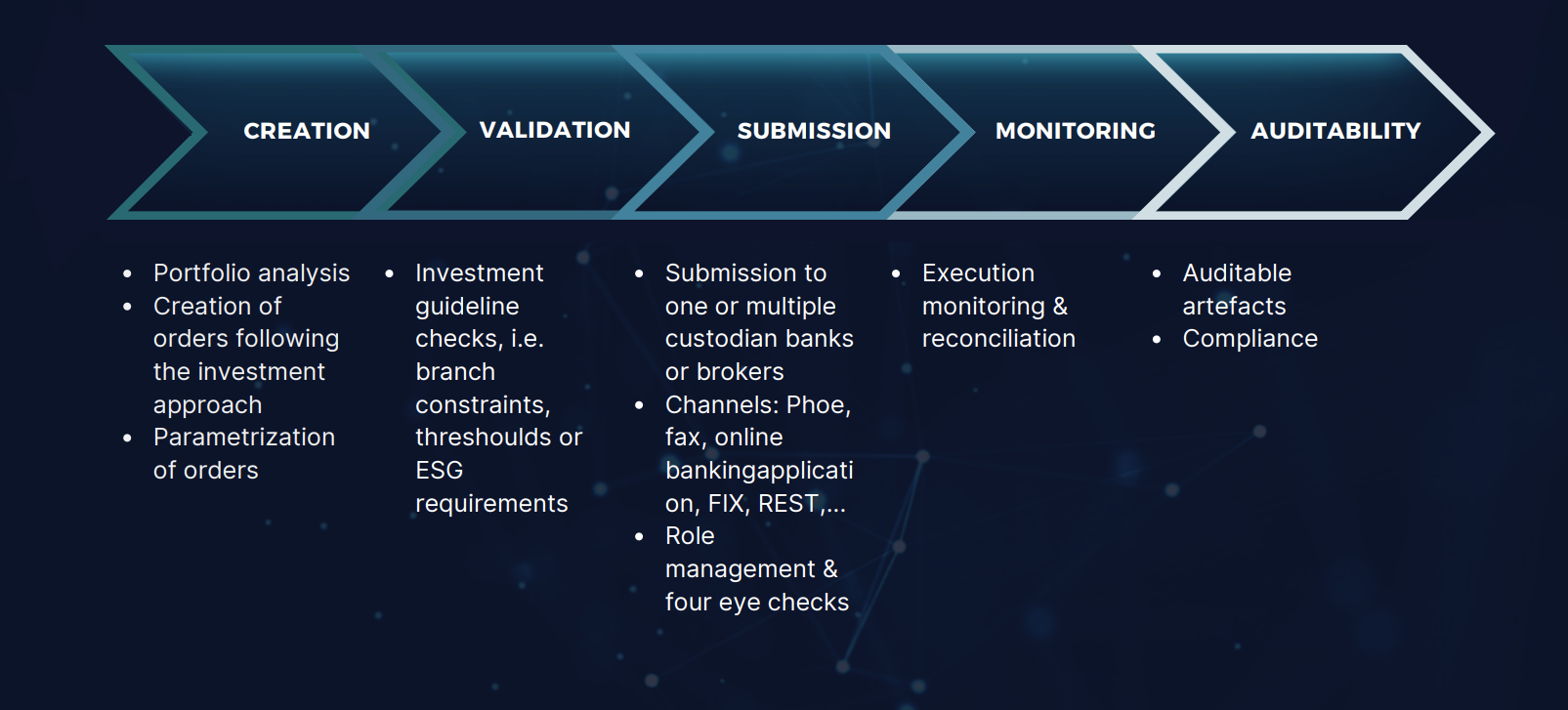

Digital order management represents a paradigm shift in how wealth and asset managers execute investment strategies. The Ordering functionality of advanced portfolio management systems like QPLIX enables automation of the following 5 trading operations steps, from creating an order to safeguarding auditability.

This holistic approach empowers you to optimise your trading operations, minimise manual errors, and ensure compliance with regulatory requirements. With the trading automation functionality in the QPLIX wealth management platform, you can gain a competitive edge by focusing on strategic decision-making rather than being overwhelmed by repetitive manual tasks.

Key Benefits of Trading Automation

- Enhanced Efficiency: Automation eliminates the need for manual trade execution, significantly reducing the time and effort required for order placement, monitoring, and reconciliation. By automating routine tasks, you can allocate more resources to high-value activities such as portfolio analysis, risk assessment, and client relationship management.

- Improved Accuracy: Human errors are inherent in manual trading processes, potentially leading to costly mistakes. Digital processes mitigate those error sources. Moreover, real-time data integration ensures that investment decisions are based on the latest market information, leading to more informed and reliable trade execution.

- Full Control: Compliance with regulatory requirements is a top priority for wealth and asset managers. Advanced wealth management platforms like QPLIX provide pre-trade checks to ensure adherence to legal guidelines, investment mandates, and client-specific restrictions. By automating compliance monitoring, you can minimize the risk of non-compliance and associated penalties, safeguarding your clients' interests.

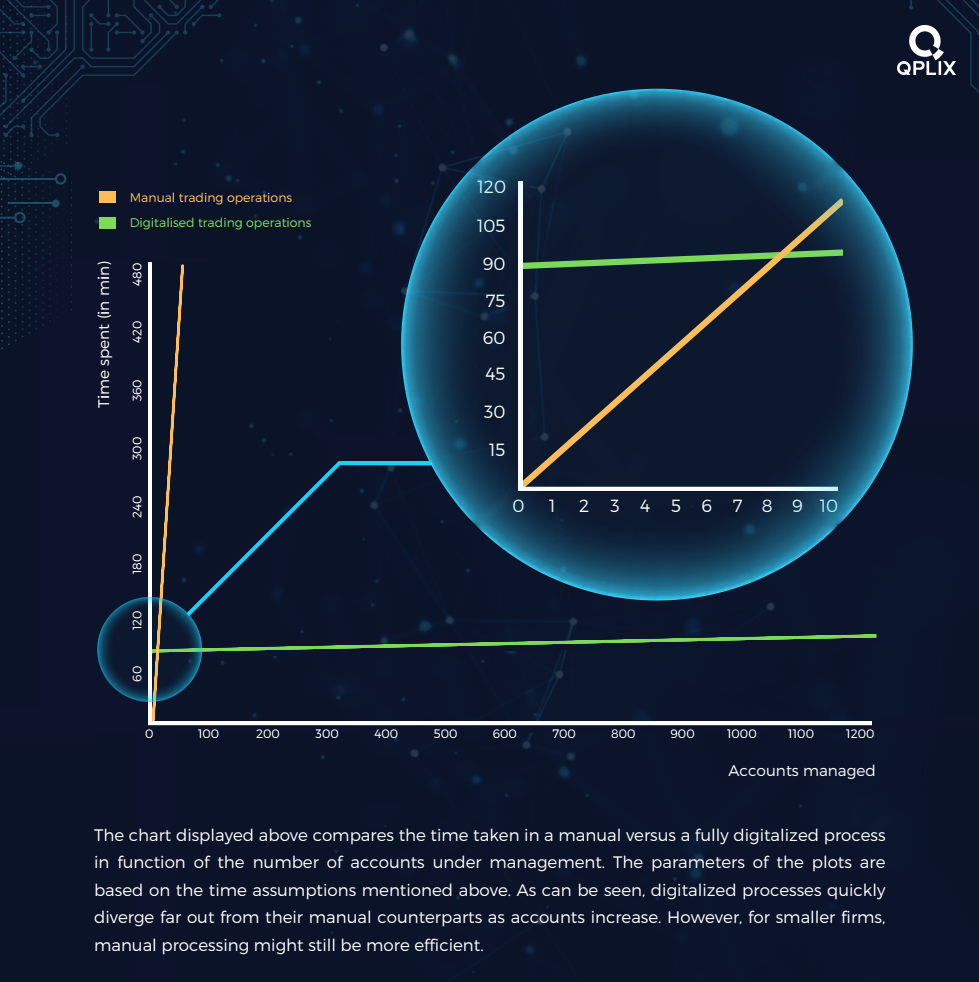

- Agility and Scalability: As your business grows, trading automation offers the flexibility to adapt and scale operations seamlessly. Whether you manage a single portfolio or a vast array of complex investment structures, an automated trading system can handle the increased volume and complexity of trades while maintaining accuracy and efficiency. This scalability empowers you to expand your business and accommodate evolving client demands.

Seamless Integration into Portfolio Management

Trading processes don't end with the execution of the order. Process integration in fully digitalised portfolio management means that orders are booked automatically and all data are available in near real-time for reporting, controlling, and client interactions. With QPLIX you benefit from data consolidation, seamless workflows and automated processes throughout the complete portfolio management lifecycle.

Conclusion

In the dynamic world of wealth and asset management, trading automation is an invaluable tool for professional managers seeking to streamline operations and mitigate risks. Leveraging advanced platforms like QPLIX empowers wealth and asset managers to enhance efficiency, accuracy, and compliance, ultimately leading to improved portfolio performance and client satisfaction. Embracing trading automation can position you at the forefront of the industry, enabling you to focus on value-added activities and drive sustainable growth.

To learn more, read the Whitepaper "MAKING THE CASE FOR THE DIGITALISATION OF TRADING OPERATIONS".

It includes sample cost-saving calculations for traditional wealth managers as well as for robo-advisors.

AUTHORS

As Director Client Solutions at QPLIX GmbH, Philip Schäfer is responsible for the overall development of new subproducts. He already joined QPLIX in 2014 and holds an MSc in Software Engineering from the universities of Augsburg, TU Munich and LMU Munich.

Alexander Kempf drives the development of the Q order module as a Product Owner. He holds a BSc in Economics from the Wharton School of the University of Pennsylvania and a BSc in Engineering from the University of Pennsylvania.